How To Invest in an Election Year

Our firm serves clients of all political persuasions, but one common question keeps coming up consistently regardless of party: “how should I invest in this election year?”

The candidates are now known, but this seems to have only made uncertainty more certain. Many people I interact with feel more fear of the other team’s candidate than love for their own. In an election year defined by anger, anxiety, frustration, and doubt, what should be done with our personal finances?

The day after President Obama was elected to his second term in office, we got a call from an investor: sell all to cash. He feared that Obama meant the worst for business and that the markets would punish him with an impending crash. The next year, it turned out, actually ended up as one of the best on record.

Wise King Solomon declared, “The prudent see danger and take refuge, but the simple keep going and pay the penalty” (Proverbs 27:12). In our context, however, it’s not clear if the danger is market collapse or that we’d be caught burying our money in the sand!

Strong emotion is not usually the friend of wise investment decisions, so great caution is advised. This question is truly one of great importance, but not just because we’re in the middle of an election. How you answer this question reveals what you believe about investing. It’s understandable that you would have doubts now, because this election has been truly unlike any other we’ve seen. But if you’re second-guessing your investments now, it’s time to second-guess your investment philosophy overall.

When clients are sitting before me and this conversation comes up, what I do not do is pontificate about how I think another President Clinton may be received by Wall Street or how a President Trump might affect our trade partnerships. If this is what you’re looking for, you’ve come to the wrong place. Instead, I point to four beliefs that guide us to an answer for that specific client:

- Investing is a long-term strategy.

Investing, specifically ownership in companies providing value to their customers and society as a whole, has significant potential for wealth creation. This growth takes time, however, and though the long-term trend for markets is historically positive, markets rise and fall based on short-term risk factors. Because stock ownership has been good over long periods, but volatile for most short periods, investing should generally be done with a mindset of 10+ years out.

Investors aren’t usually good at keeping this mentality. Over the last 20 years, the average equity investor has experienced an annual return of 5.19%, even though the S&P 500 experienced 9.85% annually over that same period. Why the disparity? The gap between these two is a result of investors making investment decisions based on emotion and buying or selling at the wrong time.

- Your investments should reflect your personal plan.

If you’re worried that money you need soon will lose value in a market crash, that money shouldn’t be invested in the first place. Because investing is a long-term strategy, it should only be undertaken with long-term dollars.

This mismatch of investments with time horizon is a common mistake I see investors make. Those who need their money soon subject it to too much market volatility, and those who are saving for 30 years from now are too worried about short-term issues.

For instance, if your investments are primarily designated for your daughter’s college education expenses and she starts her freshman year at the university in the fall, then you shouldn’t subject your money to the risk (or even potential return) of the market at all.

If you are a retiree who needs to live off your portfolio for an unknown period of time, your time horizon is different. You have both short-term needs (groceries over the next couple years) and long-term needs (groceries 10 years from now). Your short-term money still shouldn’t be put at risk. You can still take a long-term approach, however, by making sure you have built up cash reserves for up to 3 years’ worth of expenses that will make weathering most market cycles possible.

In either case, your approach would be much different from an endowment fund such as Harvard’s, whose time horizon is essentially perpetual.

- No one can predict the future.

Why is it impossible to predict the market? The market’s position today is an indication of what investors expect the future holds. So the market’s position six months from now will be based on the outlook investors see from that future date. In other words, predicting the market is not just about trying to predict the future – it’s trying to predict what the future believes about the future!

I cannot tell you what expectations will be in the world after the election (although I could make some plausible sounding stuff up), and I certainly cannot tell you what expectations will be in 2026 for long-term investors.

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” -Warren Buffett

Here’s what I do know: Uncertainty is a constant in the economy. Every decade has its own list of threats, and the news thrives off bombarding us with the crises du jour. We consistently go through cycles of expansion and contraction on a regular basis. Although we may know where we are in a market cycle, we cannot know how long a bull run or bear market will last.

Although no one can predict the future, you can prepare for it. Because the market is cyclical, switching from extremes of greed and fear, it should come as no surprise that the market will have regular setbacks.

- Investment decisions should be led by principles, not emotions.

Ultimately, since market timing doesn’t work, true investing must be done based on principles. Any other approach will lead to emotional decision-making that lead to the wild swings in the market in the first place.

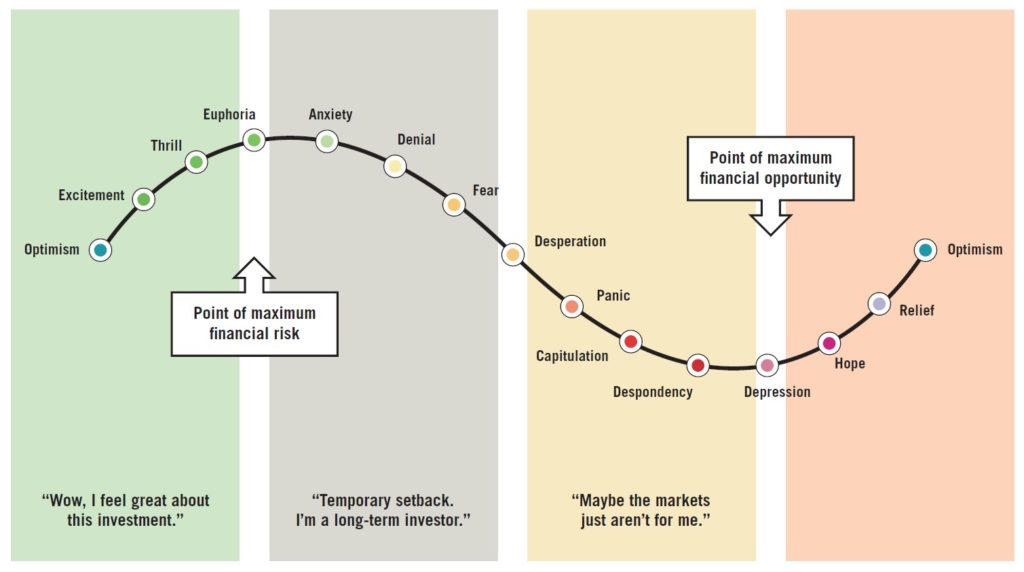

The typical emotion-based investor cycle:

What ultimately sets the best investors apart is that they take a disciplined approach to make sure their money matches their beliefs about how the economy works.

It’s easy to get caught up in the emotion of an election and let the temptation to react take over quickly. Leaders of our nation do set the direction for how the government will align or pull away from the principles you believe impact the economy. This can’t be ignored. But don’t let the short-term worry (how markets will react tomorrow) become more important than the long-term possibilities.

One final comment: King Solomon had another proverb. “The lazy person claims, ‘There’s a lion out there! If I go outside, I might be killed!’ ” (Proverbs 22:13). There’s a difference between avoiding danger because it’s prudent and avoiding danger because it’s the more difficult thing to do. However you invest, make sure that your decisions are based on thoughtful reflection and not on what feels easiest to do in the moment.

< Back to Updates