What the Dow Hitting 20,000 Means For You

You may have heard on the news that the Dow Jones Industrial Average hit 20,000 today. What does this mean? Should this matter to you?

Often called “the Dow,” this index is a list of 30 major US companies that are often used in the media to represent the overall American economy. The 20,000 valuation is based on a scaled average of what it would mean to purchase ownership in all of the companies in the list.

Not many investors actually use the Dow as an investment strategy. It’s much more common to use another, larger index, the S&P 500. But the Dow’s new record high presents an opportunity to demonstrate four general observations about investing overall.

I could talk specifically about why the Dow itself is at this new high (such as earnings growth), or go into why passive, index-based investing is how the majority of Americans should invest. But I think the Dow in particular is a great example of four lessons that all successful investors understand.

Four Observations from the Dow’s New Record High

1. Investing is ownership in real companies.

The key words here are ownership and real. Investing is not some kind of shell game, where investors try to win by guessing what’s going to happen in the future. When you make an investment, you are purchasing ownership of real companies that have real assets, real contracts, and (hopefully) real income.

The Dow Jones Industrial Average is currently composed of 30 such American companies. These companies include Johnson & Johnson, Apple, and Wal-Mart. Though originally focused on industrial companies, it’s now a broader representation of the US economy.

Each of these companies is striving to succeed. They are trying to create so much value for their customers that those customers are willing to pay them more than it actually costs to make their product. These profits are intended to flow back to the owners (shareholders) over the long-term. Taking an ownership mentality can help prevent many of the mistakes common to investors, such as market-timing and speculating.

2. The market is self-cleansing.

The original Dow index consisted of 12 companies. Do you have any idea how many of these are part of the Dow index today?

The answer is one. Out of the original companies, only General Electric is still in the index. The others have faded into history, either by merger, acquisition, or dissolution. If you had owned just one or two of these companies, your lack of diversification could have meant doom for your personal portfolio.

But the market itself has a way of weeding out underperformers and rewarding over-performers. The “market” is often mystified, but remember that we are the market. Our purchasing power, flexed over long periods and in large quantities, determines which companies we believe useful in our lives and which ones are irrelevant.

It’s hard to predict which individual companies will do well long term. By investing in the overall indexes, an investor can ride general market growth in spite of individual failures or laggards.

3. The market has gone up over the long term.

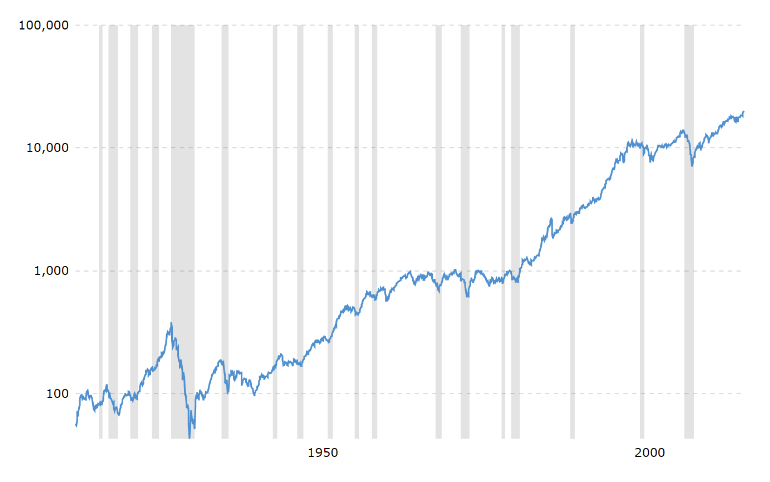

When Charles Dow and Edward Jones published the Dow index in 1886, it was originally worth 63. Since then, it’s grown annually at 9.96% (dividends reinvested). Of course, it did not achieve this growth in every year. Some years it had significant losses in value; other years were significantly higher. In the news of the day (“The market is up!” “The market is down!”), it’s hard for consumers to see and understand the long term trends.

There is no guarantee that this trend will continue over the next 100 years, and past performance is certainly not a predictor of the future. But understanding how and why markets have performed in the past is important to understand what to do in investing today. The primary reason markets have gone up over this long period is based on my first point. These are real companies with real incomes. They reinvest those earnings back into their services, thereby growing the value of their companies.

4. The market is extremely unpredictable in the short term.

Only a few months after the Dow was put together, the market experienced “The Panic of 1896.” Markets dropped and the value of the Dow dipped from 63 to lower than 29. Since then, there have been numerous “crashes,” like the 1929 or 2008 sell-offs. What many investors don’t realize, however, is how common price fluctuations like this actually are.

The gray bars in the chart above represent recessions in the US economy. It’s easy to see that recessions are relatively frequent, and it would be reasonable to expect them in the future as well. For investors wanting to own stocks long-term, these price drops may represent an opportunity to make additional purchases, actually increasing ownership.

Of course, the short term unpredictability is also why investors need to be very careful not to have short term money tied up in the market. If money is needed in the next couple of years, it would be unwise to subject it to such possible volatility, even in the interest of higher returns.

These four lessons in investing are true of both the Dow and the broader stock markets. Understanding these observations is a good start to truly understanding how to best invest, whether the goal is preparing for retirement in a 401(k) or keeping ahead of inflation over the long-term.

Applying these principles to your personal investments can get tricky, and it’s important to get unbiased counsel to avoid overreactions. If you’re looking for professional guidance, we’re always here to help.

< Back to Updates