How to Overcome Your Secret Financial Shame

Chances are high you have had a few financial mishaps in your life. Some of these may have been a result of your own misdoing; some may have happened to you. You most likely have something else in common with most adults: you don’t want others to know about those financial embarrassments.

Psychologists believe that money is now the number one social taboo in America. We’d rather talk about politics, religion, or sex before we’d share anything beyond generalities about our money issues. If you want to see someone sweat, just ask them how much money they make. Most of us have been conditioned to believe it is wrong to tell others how much money we have or make. There are good reasons for this, but there are also unfortunate side-effects.

Neal Gabler opened up about his money struggles last year in The Atlantic. In a piece titled “The Secret Shame of Middle-Class Americans,” he admitted that he was masking his true financial reality in an effort to appear to the outside world that he had his life together. His success as an author only made his financial struggles feel worse. He believed he shouldn’t be struggling. After admitting that he was anxiously living paycheck to paycheck, he wrote:

“You certainly wouldn’t know it to talk to me, because the last thing I would ever do — until now — is admit to financial insecurity or, as I think of it, ‘financial impotence,’ because it has many of the characteristics of sexual impotence, not least of which is the desperate need to mask it and pretend everything is going swimmingly.”

I see this all the time in my role as a financial advisor. These are common symptoms of financial shame:

- Regret for past financial decisions

- Embarrassment about current financial situation or the need for help

- Dread of being judged by others

- Restrictive fear of making wrong future decisions

- Embarrassment for not having performed as well as someone else, such as a family member, classmate, or friend

- Descriptions of oneself as “stupid” or “a failure”

Do you recognize yourself in any of these descriptions of financial shame? There’s hope. In fact, one thing I can emphatically emphasize is that there is always hope. No matter how bad you feel about your current financial situation, there is a way forward. I’ve yet to come across an unsolvable case. But your shame itself could be the biggest roadblock to your success. With that in mind, here are four recommendations for helping you overcome your financial shame:

1.) Recognize you are not your money mistakes.

Do you know the difference between guilt and shame? Guilt says, “I did something wrong.” Shame says, “Something is wrong with me.” Guilt focuses on behaviors, but shame focuses on identity. Feeling guilty over past money behaviors can actually be healthy because we can make progress when we admit and learn from our mistakes. However, for many of us, those feelings blossom into shame. We convince ourselves that we made money mistakes because something is wrong with us.

Brad Klontz, financial psychologist and author of Mind Over Money, says “The biggest piece of information that I’d like to let people know is that their financial troubles are not the result of them being lazy, crazy, or stupid, and they’re not alone. If you’re stressed out about money, you’re the average American.”

If you’ve made money mistakes, nothing is wrong with you. Everyone makes mistakes. In fact, it’s possible that your mistakes could actually be what makes you. When Dave Ramsey declared bankruptcy in 1987, his story could’ve ended as the guy who built up a real estate business then burnt it to the ground. Rather than dwelling on his past mistakes, he focused on the lessons he learned from them, lessons he eventually built into an advice-giving media empire.

Think about this: when he wrote his first book Financial Peace in 1992, what credentials did Dave Ramsey have? At that point, his failure could have easily prevented him from success. Instead, he used his failure to help steer others away from his same past behaviors.

2.) Acknowledge that your journey is your own.

The number one question I get as a financial advisor is, “How am I doing?” We all have an innate drive to look at others to help us evaluate ourselves. Social psychologists call this phenomenon Social Comparison Theory. No one likes to admit to “keeping up with the Joneses,” but this is exactly what human nature strives for.

But it’s very difficult to accurately compare our own financial journey to someone else’s journey. I’ve had the unique advantage of seeing behind the financial facade of hundreds of individuals (most of them considered high net worth). I’ve sat with couples weeping over their impending financial doom… as others look at that same couple’s belongings with envy.

Comparisons are a trap because they are often based on a false interpretation of reality. Just because someone is driving an expensive, new car doesn’t mean they can actually afford such a car. Comparison also fails to include our different starting lines, opportunities, and setbacks. A business owner friend of mine often compared himself to another who started a similar business around the same time. He admitted to feeling embarrassed when he compared the empire this other business owner had amassed to his own venture. He had not realized, however, that the other individual had started out with a family fortune of millions in the bank. This fortune allowed him to expedite growth. My friend started his company with nothing but a laptop, and it will have sales of over $1 million this year — a feat only 4% of entrepreneurs ever achieve!

We all start out with different economic circumstances and lessons passed down to us by our family. But comparison is an enemy of contentment. Fulfillment will never come by measuring yourself against another. So be patient with yourself and acknowledge that no one else has taken the exact road you’re on. Don’t give in to the imposter syndrome.

3.) Open up to someone you trust.

Progress is difficult on your own. Like all areas of behavior change, financial progress often comes through accountability, community, and relationship. Fear thrives in isolation. Therapists like to say, “You are only as sick as your secrets.”

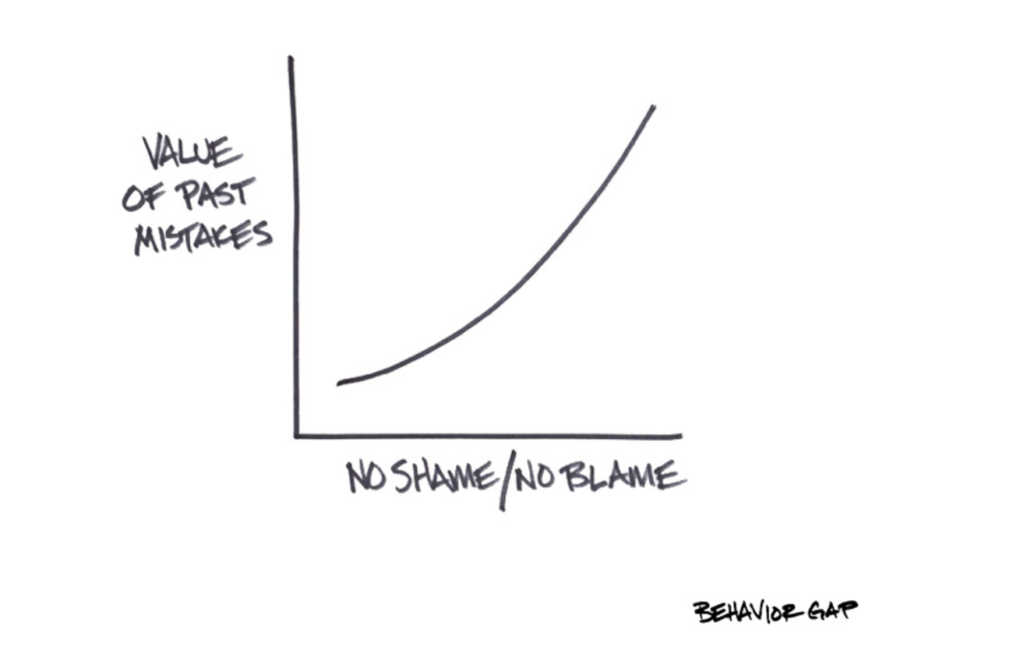

Open up about your financial struggles with someone you trust, such as a friend, pastor, or financial advisor. Real advisors are here to help, never to judge. Carl Richards, a financial author at Behavior Gap, jokes about wearing a hat with “No shame / No blame” written on it to help clients know they’re in a safe place to have positive conversations. I haven’t broken out a hat yet, but I often remind clients that I’ll never judge them for the past. I’m only here to help them make better decisions in the future.

If you don’t know who to turn to, start by reaching out to a Fee-Only financial advisor. The Fee-Only part is important, because it means that they should be able to give you advice without needing to sell you any investment product or insurance. There is also a Financial Therapy Association, which lists advisors who focus on helping clients develop a healthy relationship with their money.

4.) Investigate what’s holding you back.

All of us have inherited or learned particular money beliefs that instruct our financial decisions. We call these beliefs money scripts, and very few people actually understand their own. Yet these beliefs can be the number one predictor of financial behaviors. So an important step in overcoming financial shame is learning what beliefs led to past behaviors.

There are a number of ways to get started. Brad Klontz recommends a series of questions to help you identify your subconscious beliefs. We utilize a “Money Script Inventory” with clients that researchers at Kansas State University developed based on the four most common sets of money beliefs. However you begin, write down what you actually think about money and how it has impacted your decisions throughout your personal history.

If you deal with a form of financial shame, you do not have to live with it forever. The wealthiest clients I’ve ever worked with were not people who had spotless financial records. What set them apart was their ability to move past financial mistakes and make the best of them. No matter where you’re coming from, there’s hope for your financial tomorrow.

< Back to Insights