Is now the time to buy Bitcoin?

When my clients in their late eighties unanimously ask if they should buy Bitcoin, it’s probably time we should address the question. Should you invest in Bitcoin?

There’s no escaping the Bitcoin question these days. Before the pandemic, I stopped telling Uber drivers what I did for a living, because they would inevitably spend the rest of the drive plying me for advice on cryptocurrency.

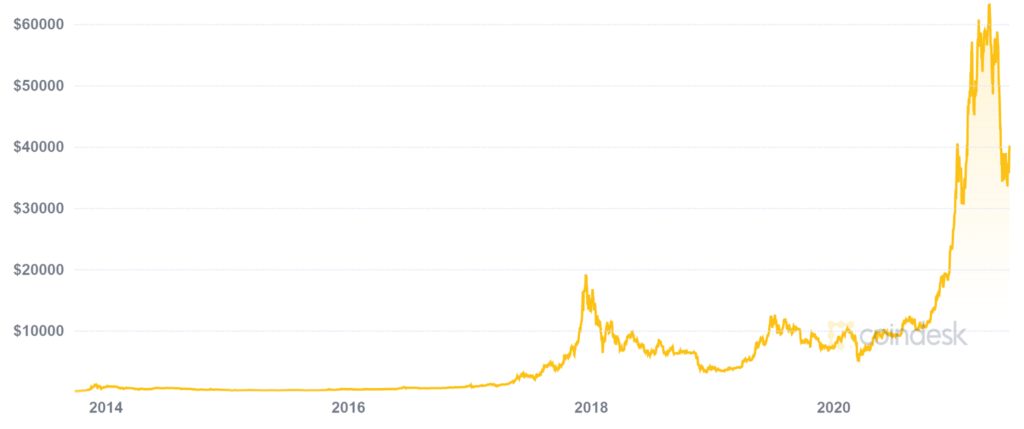

We’ve all heard the stories of kids who put all their life savings into Bitcoin and struck it rich. These young millionaires get to retire before they even get started, while the rest of us are stuck doing work the hard way. “If you’re not a millionaire in the next decade, it’s your fault,” declares one teenager. Another holds up a sign saying that’s not enough: “A million dollars isn’t cool. You know what’s cool? A BILLION dollars.” They make making money look so easy. Using their tips others have flocked to cryptocurrencies, attempting to find outsized returns and turn a little money into a lot in just a few short months. Early in 2021, the price of Bitcoin surged again, pulling in an entire new round of buyers.

1 Bitcoin to USD – 9/30/2013 to 6/15/2021 – Source: Coindesk

The rush to join in

Almost everyone I’ve met buying Bitcoin has the primary goal of “not missing out.” As WSJ columnist Jason Zweig said during the last Bitcoin rush (2017), “The gravity-defying rise of bitcoin has been drawing in new money from people who appear to know nothing about the cryptocurrency other than the fact that its price has gone up a lot in a hurry.”

This is a horrible reason to buy something. If the only ingredient in an investment is “hope,” you have a recipe for disaster.

Of course, it’s possible to win big (as the stories above illustrate). These stories activate a part of our brains that trigger an emotional response. The emotional flooding makes it easy to override caution.

From what I can tell, Bitcoin has only spiked when it has because of speculative demand. The price pops because people start getting interested in it with the goal of making quick money. As more people rush in, the price is driven up. This is how every speculative bubble has happened, from the Beanie Baby mania in the 1990s to the Dutch tulip frenzy of the 1630s. Every bubble pops.

Bitcoin as a medium of exchange

However, cryptocurrency is very different from plush stuffed animals easily produced or tulip bulbs plentily available. A substantial increase in price doesn’t automatically make something a bubble.

To understand the argument for Bitcoin, you have to understand its purpose. Bitcoin is a digital currency, created anonymously and released to the public in 2009. Because it is designed on the new technology blockchain, transactions in the currency are decentralized – meaning Bitcoin can’t be manipulated by a central agency or government. It has a fixed supply, so it is theoretically immune to inflation. However, its price relative to US dollars fluctuates wildly, making it difficult to use as a currency.

Those interested in using Bitcoin to buy/sell things will find serious difficulties. First, high transaction costs make many transfers too expensive to process. Currently, it costs the equivalent of about $6 per Bitcoin transaction. This means the transfer has to be valuable enough to justify that fee. Your $6 Frappuccino would suddenly cost $12 because of the fee. And when Bitcoin demand is high, those transaction costs go up. Earlier in 2021, trading costs reached more than $60 per transaction.

These costs become an even greater issue for businesses who also need to pay their employees and vendors. Online platforms are being developed that will hopefully bring down those costs. But since most vendors (and employees) still want to be paid in US dollars, the business owner accepting Bitcoin is also subject to the wild swings in value between Bitcoin and dollars.

It’s ultimately this conundrum that makes Bitcoin a poor investment. To live up to its promise as a currency, it needs to stabilize. If the volatility stabilizes, it becomes far less interesting as an asset.

Bitcoin as a store of value

What about the arguments for bitcoin as a diversification asset and a hedge against inflation? Proponents argue that Bitcoin’s limited supply will ensure it is a good store of value over time. In this sense, they think of the digital currency almost like an electronic version of gold.

However, limited supply only buttresses value if demand is also consistent over time. What happens if a new cryptocurrency becomes more popular, or regulation makes Bitcoin less enticing? Beanie Babies also had a limited supply, however their value suddenly dropped once they were no longer in vogue. There is no guarantee that the interest in Bitcoin will persist. And economists are finding that its volatility makes it a poor choice for diversification alone. At the end of the day, Bitcoin has no intrinsic value. You could argue US dollars only have value because the US government says they do – and everyone takes them at their word. Those buying Bitcoin as a store of value are betting that the number of people who start sharing this belief eventually become the majority.

How to buy Bitcoin responsibly

I am not opposed to ever owning Bitcoin or other cryptocurrencies. To clarify: it’s certainly possible that purchasing Bitcoin could be a successful financial move. But I am cautioning that those who purchase this should understand exactly what they’re getting into. If for some reason you decide to go ahead with it, here are some thoughts on how to go about this responsibly:

- Understand the purpose for these dollars. Never invest without understanding your goal for the money involved. Attaching a purpose to each dollar helps you avoid taking more risks than reasonable. For instance, is this money part of your cash reserves? If so, the volatility of cryptocurrency would mean you might have a lot less than needed in an emergency. This is no different than when deciding how to invest any other balance. However, I believe any money you invest in crypto should be considered “fun money”, without another specific objective.

- Never buy more than you can afford to lose. Most buying cryptocurrency are not actually investing – they’re speculating. Understanding the difference between investing and speculating is critical to being realistic about your possibilities and risks. Speculating with crypto is just like speculating in the housing market or precious metals. You’re buying an asset hoping someone else will want to pay even more for it. Hope is not a good strategy to risk dollars critical to your long-term success.

- What’s your plan? When do you hope to sell your cryptocurrency? Do you want to own it forever, or are there upper or lower price limits that would change your mind? Answering these questions ahead of time can help you avoid making emotional mistakes in the middle of a market event.

- Use a trusted platform – and don’t lose your password. If you do decide to go forward with buying cryptocurrency, there are a myriad of methods… and just as many mistakes you could make. An error could mean making yourself vulnerable to hacking or locking yourself out of your money. If you don’t know the difference between a hot wallet and a cold wallet, proceed with caution and research carefully.

- Understand the consequences of selling. If you do make money trading Bitcoin, don’t forget that those gains are taxable. Keep track of trades so you know your basis and total profits. With the IRS becoming more aggressive in its search for cryptocurrency traders, reporting those gains on your tax return will be critical to avoiding audits or worse.

It’s important to consider both the possible risks and rewards of buying Bitcoin when deciding if it’s the right choice for you. If you aren’t sure which way to go and would like more advice, we’re here to help! Talk to one of our Wealth Advisors about your goals and to create a personalized plan.

< Back to Updates