4 retirement challenges and how to face them with confidence

Are you experiencing more fear than usual right now? The financial world has seemed especially crazy this year. Money anxieties can get especially worse if you’re facing retirement. It’s easy to go down the rabbit hole of fear, especially when the world feels unpredictable, but that’s not what we want for the people we serve.

So how does someone retire not knowing what the future holds? One adage we use is this: We can’t predict, but we can prepare. No one knows the future. But there are practical steps to prepare for the unique challenges of retiring in a difficult year. Here are a number of today’s most common challenges, and how we’re helping current and future retirees prepare wisely to face retirement with confidence.

Retirement challenge #1: Inflation

Yes, prices are rising. The consumer price index was 9.1 percent higher this June than it was last year.1 Inflation headlines are all over the news, and you are most likely noticing higher prices in your daily purchases.

Our economy still has issues to work through brought on by pandemic supply-chain disruptions. And Russia’s invasion of Ukraine has added to the chaos by raising global energy costs.

Inflation is scary not just because prices have already gone up; most of the fear comes from not knowing how high prices might keep going in the future. There’s already hope that costs are starting to slow down. But no one knows how high they’ll go.

Statistically the long-term inflation rate has averaged around 3 percent. In the past two decades, it has been lower, hovering around 1 or 2 percent. Since it’s been low for so long, it shouldn’t come as too much of a surprise that we’ve now swung the other way. Now might be a good time to proactively make a spending plan.

Some sources of retirement income make annual adjustments when inflation goes up, such as Social Security. Pensions and annuities sometimes offer cost-of-living adjustments as well. But these are not available to everyone, and they often come with significant downsides, such as high costs and no flexibility once you’re enrolled.

A well-balanced, diversified portfolio takes inflation into account and can get inflation working for you. Series I Savings Bonds are another way to make lemonade out of inflation lemons. In short, when inflation fears strike, take a long-range view and stay invested.

Retirement challenge #2: Problematic stock market

After such a long period of investment growth, it can be easy to worry when investment values drop.

Even though it’s impossible to predict when the stock market will drop, it should come as no surprise. Recessions and market fluctuations have happened regularly in US history, and it would be foolish to make a retirement plan assuming they won’t happen again.

Instead of predicting, we prepare our clients to weather market tempests in retirement, often using the bucketing approach. In this strategy, money is divided into three different “buckets” according to long-term, medium, and immediate needs. If the reserves in the medium and immediate “buckets” are enough, it’s a lot easier to wait out the market chaos. Even within the long-term bucket, tools such as a bond ladder bring predictability to a portfolio that needs to make distributions. Bear markets don’t have to send retirees running for the hills. When stocks slip, take a break from looking at your accounts daily and remember you have a wisely diversified portfolio to carry you through.

Retirement challenge #3: Housing headaches

This past year’s high housing values led many current and soon-to-be retirees to consider selling their homes and cashing in. The other side of that coin is being able to find (and afford) a new home after selling!

I’ve seen retirees sell quickly only to have their moving plans fall through. Others want to downsize but find their tastes have risen along with their incomes over the years. Smaller houses can be just as expensive in higher price point or maintenance-included neighborhoods!

We help our clients think through home buying and selling decisions thoroughly. We also stand by our claim that one of the best things you can do to prepare for retirement is paying off your mortgage ahead of time. When high home values tempt you to sell fast, do your research before making rash decisions.

Retirement challenge #4: Fear and uncertainty

When I read about today’s high levels of consumer pessimism, I think back to what it was like during the recession of 2008-2009. While I do work with a more prosperous part of society, in general, people’s personal finances seem to be in a much better position today. Yes, the headlines can make it feel like the world is out of control. But your financial decisions don’t have to be.

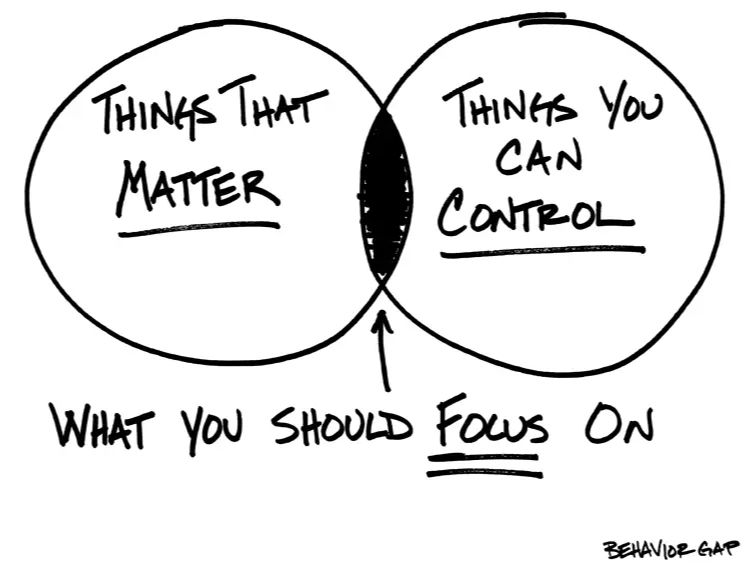

The reality is that there are many things that are outside our control. This doesn’t change when you retire. But it seems retirees feel more vulnerable to those uncontrollable forces. At the end of the day, if it’s outside of your control, then it may not be the best use of energy.

There are, of course, things you can do to be better prepared for what’s ahead. When you follow the Sound Stewardship Principles, you make financial choices based on time-tested wisdom, not passing circumstances. You can be confident that God’s got this and remain content in your long-term retirement strategy.

< Back to Updates