Are You a Customer or a Client?

In the relationships you have with financial professionals, are you a customer or a client?

Understanding the answer to this is incredibly important in understanding the type and scope of the advice you’re getting.

In Benjamin Graham’s book Intelligent Investor, he briefly explains the types of advisors investors can consult for counsel. He highlights this subtle-but-important distinction between being a customer or a client. What’s the difference?

In a customer relationship, solutions always revolve around a product. The product could be a specific investment, annuity, or insurance policy. But the advisor does not get paid unless a transaction happens.

In a client relationship, solutions always revolve around advice. Although implementation may be involved, the relationship isn’t dependent on a particular product being used.

Both can be useful. As a fee-only advisor, all of my relationships are client relationships; I am not allowed to sell any products. But when a client needs life insurance, they utilize a professional who competently implements the policy they need. It’s not good vs. bad. What’s important is that you understand the type of relationship you have.

Understanding the relationship will help you understand the motivations of the advisor you’re working with. As Warren Buffett has said, “Never ask a barber if you need a haircut.”

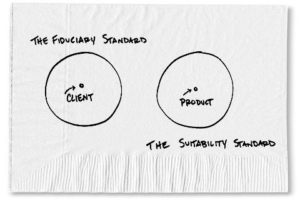

The Fiduciary Standard

Another question that can help you understand the nature of your advisor: “Are you a fiduciary?”

Being a “fiduciary” means the advisor is obligated to act in the best interest of the client. You might be surprised that not all advisors are fiduciaries. But if they are, they are required by law to:

- Act in the client’s best interest with undivided loyalty

- Avoid any conflicts of interest

- Fully disclose in writing everything a reasonable investor would want to know about them and the firm (like all sources of income and any potential conflicts).

If someone is not a fiduciary, they are still expected to treat their customers fairly, by making sure the product they’re recommending is suitable for the particular person. Suitability seeks to answer, “Is my product a good fit for this person?” And a fiduciary seeks to answer, “What is the best thing for this person?”

(image source: Carl Richards, Behavior Gap)

(image source: Carl Richards, Behavior Gap)

Having the facts

Again, it’s ok to be in both customer and client relationships. Both fiduciaries and non-fiduciaries can be helpful. But don’t be fooled into thinking you have someone acting in your best interest. Ask the question and make sure you are comfortable with the answers: am I a customer or a client?

AROUND THE WEB: This short video offers another analogy to help explain the difference between those who are fiduciaries and those who are not.