Company Stock Options giving you a headache? Three questions you should answer!

Whether you’re a new hire negotiating your compensation package or a long-time employee who has never had an intentional strategy for your stock options, you need to pay attention in order to make the most of your stock-based compensation. Because they are just that—options—until you exercise your right to use them.

Many companies offer stock options to their employees as a way of incentivizing them to work hard for the success of the company. Within a certain number of years, you are given the option to buy a number of shares at a set price (the grant price). Ideally, your company’s stock price will rise significantly, so you’ll be able to acquire more valuable shares at a much lower price.

The value of those options depends on a lot of factors, so it’s important to talk with a trusted financial advisor who can help you make the most of the opportunity. We’ve heard of employees who simply forgot to exercise their options within the set timeframe and lost them completely. Don’t be like them! Educate yourself early. Here are three things you need to know about your stock options:

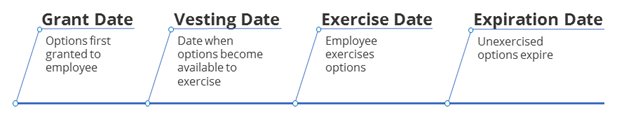

1. What are your Plan’s key dates and features?

You will sign (or have already signed!) a contractual agreement regarding your stock options. Make sure you know these important plan details:

- The grant price: This is the price you will be able to buy your shares for in the future. It’s most often the price of the stock on the day the options are granted to you. (If the company isn’t publicly traded, the grant price is based on a valuation of the company.) This price is locked in and doesn’t change.

- Number of options granted: This is exactly what it sounds like. How many shares do you have the opportunity to buy?

- The vesting schedule: What percentage of the options can you exercise and when? For example, you might be able to use 25 percent of your options after the first year, another 25 percent after the second, etc.

- The expiration date: Typically 10 years from the grant date, this is when you lose your right to exercise your stock options. Use them or lose them.

- The impact of termination and/or retirement: Some plans say if you are terminated with cause, you lose your options. Some give retirees a certain number of years to exercise their options, and some stipulate you have to exercise your remaining options on the day you retire.

2. Which type of stock options do you have?

- Non-Qualified Stock Options (NQSOs) are the most common form of stock options. You will pay taxes on the difference between your grant price and the exercise price. It’s important to get the advice of a trusted financial advisor, then coordinate with your custodian and payroll provider to make sure you are withholding the right amount of payroll taxes. Your earnings from exercised stock options could bump you into the next tax bracket and/or put you over the top of the Social Security maximum earnings cap. Get your big tax picture before exercising! Your total taxes can easily top 40 percent:

- Payroll taxes will be withheld: 6.2 percent for Social Security and 1.45 percent for Medicare. (Unless you’ve already hit the maximum earnings Social Security cap, currently $132,900.)

- There’s an additional Medicare excise tax of 0.9 percent for higher income earners (Generally $200,000, or $250,000 for married taxpayers filing jointly, or $125,000 for married taxpayers filing individually.) Do your stock options push you beyond these thresholds?

- You’ll pay federal and state income taxes at predetermined rates set in your stock option plan agreement. Make sure you plan ahead for that tax payment.

- Incentive Stock Options (ISOs): This less common form of stock options isn’t taxed upon exercising. Instead, if you hold your acquired shares for at least two years from the date of the grant and one year from the date of exercise, you can incur more favorable long-term capital gains tax rates (usually around 15% instead of the 20-30%+ short-term capital gains rates) on all appreciation over the exercise price. But watch out for Alternative Minimum Tax (AMT) thresholds: paper gains on shares acquired from ISOs and held beyond the calendar year of exercise can subject you to AMT.

3. When should you exercise your options?

Once you know all the details on your stock options, sit down with your financial advisor to talk about your stock option exercise strategy. Here’s what you should discuss:

- What’s your purpose for the money? It’s wise to pair a real reason for exercising your stock options (beyond “they’re going to expire”), so you can balance the tax implications against how much you need. For example, if you’re using options to pay for a child’s college tuition, you’ll need to calculate how much of the income from the shares will be lost in taxes in order to have enough to cover your costs.

- What percentage of your net worth is in company stock? Concentrating net worth in one (very valuable) stock can create great wealth, but it’s a double-edged sword. Conservative experts advise limiting exposure in one specific stock to 5-10% of your total net worth.

- What’s your exercise price target? Know what price the stock needs to reach in order for you to cover your goals (college tuition, mortgage payoff, new business investment, etc.).

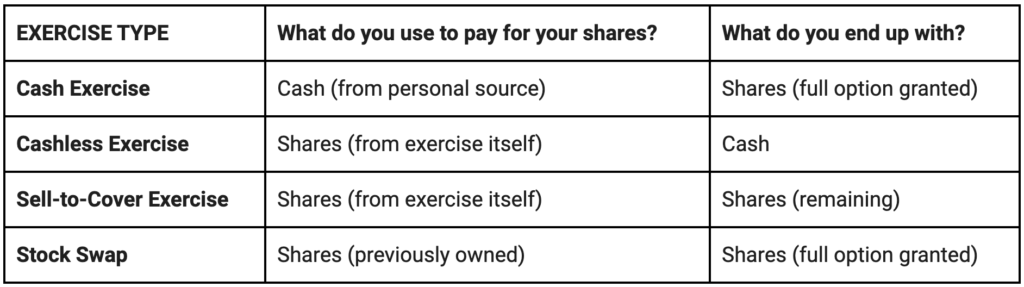

- What are your choices for exercising? There’s always a price to pay for free money, and stock options are no different. To exercise your options, you need to pay for their grant price value. There are four main ways to do this:

- Cash Exercise: You write a check for the value of your shares at the grant price, which hopefully is much lower than their current value. Like any other investor, you then own those shares, and you can do whatever you want with them. (See tax consequences above.)

- Cashless Exercise: You essentially sell your shares back to the company. You get a check for the net value of those shares—minus the taxes, expenses and original grant price. This is the simplest exercise option, but often the most disappointing if you haven’t estimated what your options are worth post-tax. This is typically about half of their face value.

- Sell-to-cover: You sell some of your stock option shares to cover the grant price, taxes and expenses. You own the remaining shares, similar to the cash exercise, but no cash is needed for the transaction.

- Stock Swap: This is less common, but you can also use shares you already own (through a previous exercise or personal inventory) to cover the grant price, taxes and expenses. You own the full amount of stock option shares, and no cash was needed for the transaction.

Do you see how complicated this gets, and how quickly? The bottom line is you need to understand your stock options—and all the options for the options!—to get the most out of them.

We’d love to help. Talk to one of our fee-only financial advisors to set up your stock options consultation.

< Back to Updates