Numbers You Need to Know for 2025

As we enter 2025, it’s important to stay updated on key financial numbers that can impact your planning and savings strategy.

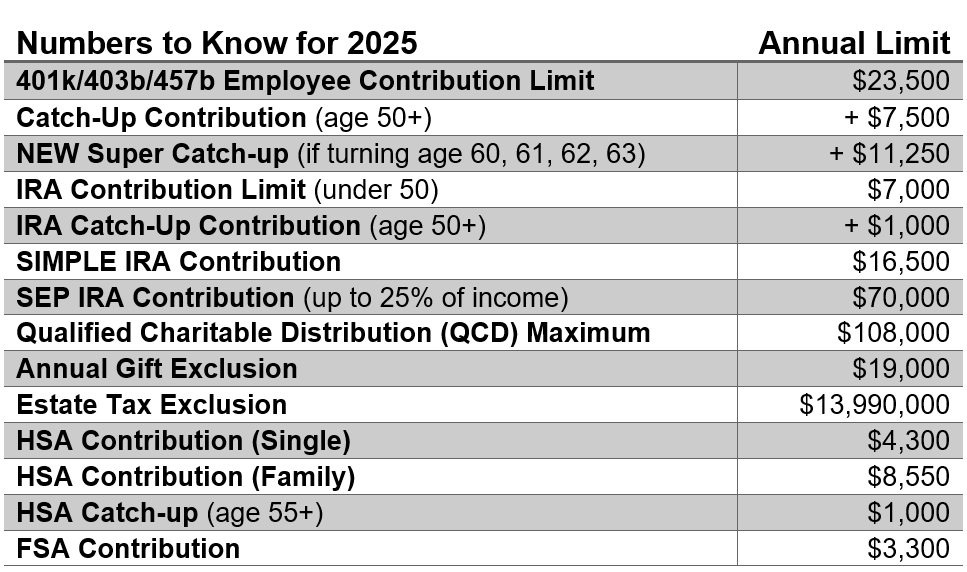

The biggest change this year includes a new 401(k) “Super Catchup” for those who turn ages 60-63 in 2025. Those in that age bracket get to set aside up to $34,750 into their retirement plans.

Another twist is the increase of the Qualified Charitable Distribution (QCD) maximum. Those over 70½ can send up to $108,000 in 2025 directly from an IRA to a charity. These gifts count toward required minimum distributions (RMDs).

One number that did NOT increase is the IRA or Roth IRA contribution limit. This remains at $7,000 for 2025.

Here’s a rundown of the important limits and changes to keep in mind:

Retirement Contributions:

- 401(k) Contribution Limit: $23,500

- 401(k) Contribution with Catchup (if you’re 50 or older): $31,000

- NEW 401(k) Contribution with Super Catchup (only for ages 60-63): $34,750 (this is the ‘super catchup’ contribution for those closer to retirement)

- IRA and Roth IRA Contribution Limit: Remains at $7,000 (subject to income limitations, but a Backdoor Roth IRA could apply)

Health Savings Accounts (HSAs):

- HSA Contribution Limit (Individual): $4,300

- HSA Contribution Limit (Family): $8,550

- Additional HSA Catch-Up (if you’re 55 or older): $1,000

Flexible Spending Accounts (FSAs):

- FSA Contribution Limit: $3,300

Charitable Giving:

- Qualified Charitable Distribution (QCD) Limit: Now $108,000 (a significant increase for those looking to donate directly from their retirement accounts)

- Standard Deduction to Exceed to Benefit from a Charitable Gift:

- $15,000 for Single Filers

- $30,000 for Joint Filers

Estate and Gift Planning:

- Annual Gift Tax Exclusion: $19,000 per person

- Estate Tax Exclusion: $13,990,000 per estate

Social Security:

- Social Security Cost-of-Living Adjustment (COLA): 2.5%

These numbers can help you make informed decisions about contributions, deductions, and overall planning. With some significant increases in contribution limits and changes to tax-related thresholds, now’s a great time to review your financial strategy with a professional to ensure you’re maximizing your opportunities for the year ahead.

Feel free to reach out if you have questions about how these updates apply to your personal situation!

< Back to Updates