The Least Sexy, Most Important Money Skill

Saving money is an important 21st century survival skill, and Americans are especially bad at it. According to a study by the Federal Reserve, nearly half of Americans would not be able to come up with $400 of savings in case of an emergency. And this is uniquely an American problem. For instance, look at these results from an international study:

Household Savings Rates, under age 30:

- Germany: 9.8%

- Italy:10%

- Japan: 17.9%

- United Kingdom: 5%

- United States: -2.2%

Yes, that is a negative savings rate next to our name. Sad. Bigly sad.

Before people start their rants against Millennials, I need to note this study was done a while ago – long before the term “Millennial” was created (solely for the purpose of complaining).

But the savings rate hasn’t gotten any better. With high consumption lifestyles plus readily available debt, it’s no particular surprise to anyone. The average debt-holder in America currently holds about $8,000 in credit card debt, $26,000 in student loans and another $10,000 in car loans. After all, can you expect these Millennials to drift far from the examples of their Baby Boomer parents?

It wasn’t always this way. For decades, Americans took a more prudent approach to saving. As recently as the first Reagan administration, the bottom 90 percent of households saved 10 percent of their income. Now, living above your means is probably the most common money mistake. And I don’t think people are ready for a #MakeAmericaSaveAgain campaign.

Saving is the only way to make progress on financial goals. Without saving, you cannot get out of debt. You cannot prepare for retirement. You cannot take those dream trips or give in big ways. If someone is having trouble getting unstuck with a financial plan, there’s a high probably that it’s a saving issue.

This is a problem at all income levels. I was astounded when I discovered the probability of long-term credit card debt goes up once incomes pass into the 6-figure range. Higher incomes may actually seduce people into spending more than they should simply because they think they should be able to afford it. It does not matter if your boat is a 10-foot rowboat or a $100 million yacht, if there’s a hole in the boat you’re going under.

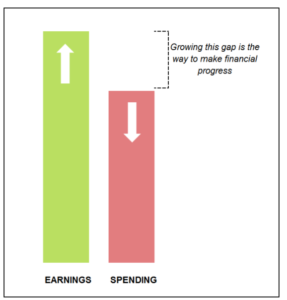

If you’re not saving, you either need to:

- Increase income, or

- Decrease expenses.

Unfortunately, that’s about as complicated as it gets. I wish there was a magic wand I could wave to make it easier. I’m sure if I did, it would also make dieting and exercise a snap too. But like most skills required for a healthy lifestyle, saving is simpler said than done.

Trying to improve both spending and earning is the best way to make progress. The difference between these two is your “spending gap.” It’s time to heed our British friends and “mind the gap.”

If you need help making progress on your financial goals, Sound Stewardship serves as a “financial fitness trainer” for those with money momentum. Reach out to a Wealth Advisor today to talk more.

< Back to Updates