Three Questions for More Strategic Giving

If you had a million dollars to give away this year, how would you do it?

No, really — stop and imagine this. How would you go about giving away a million dollars in the next 12 months? Would you donate haphazardly, or would you dedicate time to think carefully and develop a plan?

If you would strategically give away a hypothetical amount, why don’t you plan your actual giving?

It seems few people have any form of strategy in their giving. Jake & Kate, for example, used to take what I call the “shotgun approach” to donations. As many gifts to as many organizations that asked. Their “strategy”, if they had one, was to simply give $1,000 at a time to charities, usually whenever organizations they supported in the past wrote an appeal. If a friend would invite them to a charity chicken dinner, they’d write a $1,000 check. They both really appreciated the work of a local mission, so they often donated $2,000 at a time here.

Over time, these gifts added up: they sent many thousands of dollars to nonprofits, with the potential to send many thousands more. But in spite of their generosity, they still felt unsatisfied. This approach felt reactive, sporadic and unfulfilling. Their impact in the community was unclear.

Making the shift towards strategy

Jake and Kate decided to make a change. They wanted to make a lasting impact and teach their three high school-aged children what generosity looks like. They took the time to put a strategy in place, and now they’re finally feeling excited about the difference they can make.

Taking the shotgun approach, but hoping to give more strategically? Here are three questions to help you get more focused in your charity:

1. How much do you want to give away?

When considering your giving plan for the year, it’s natural to begin by brainstorming organizations or causes to support. But a successful strategic giving plan often starts with a number in mind. Try first asking, How much do we want to give way this year? Defining how much “giving ammunition” you have for the year will help you stay out of reactive mode.

Many people like the guideline of giving 10% of income — and this can help you start with a round number. I’ve yet to meet anyone who’s regretted donating at this level (unfortunately, 2% is the national average). But if you have the means to give even more generously, don’t let the 10% “tithe” limit you. If you set big goals in any area of your life, why not set a big giving goal?

Jake and Kate have been blessed with high income jobs and earn a combined $500,000 a year. After prayerful consideration and working with their financial planner, they made the decision to give away $100,000 this calendar year. Their financial planner helped them send $100,000 throughout the year to their family’s Giving Fund (a Donor Advised Fund) in way that helped them get the biggest tax advantage possible. Though tax deductions aren’t the reason they give, they still want to make sure they don’t leave any available tax benefits on the table.

2. Where would you like to make an impact?

After you’ve established the total amount you’d like to give away this year, create a “spending” plan. In the same way that you and your family would set a monthly budget (a portion for groceries, a portion for utilities, etc.), split your total among the different types of causes that are close to your hearts.

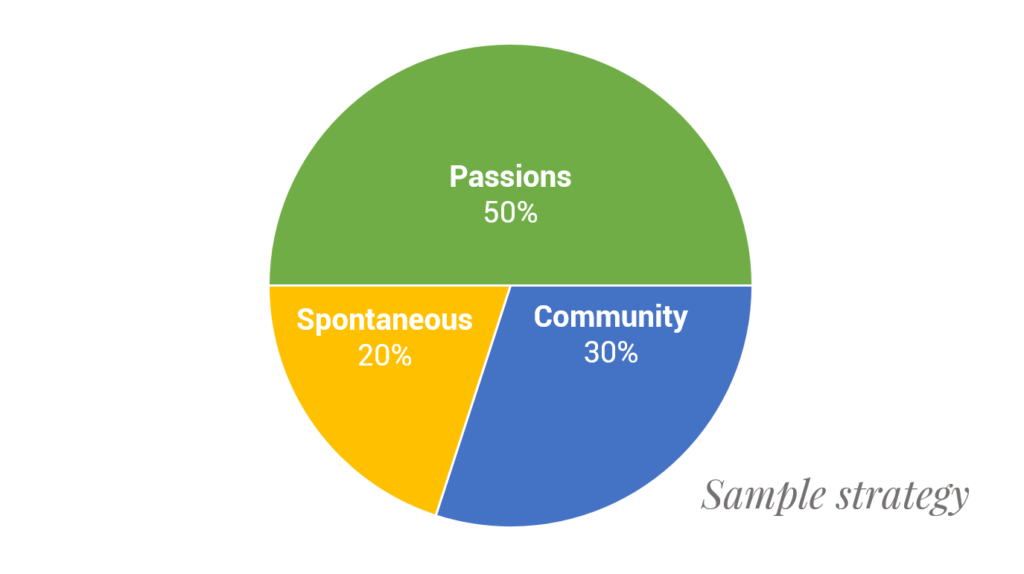

To get started, consider this formula:

- 50% passion giving: What difference do you want to have in the world? What impact would you like your generosity to make? What cause do you feel particularly called to?

- 30% community giving: What aspects of your community are you committed to? This could include anything from local arts and culture organizations to community-focused human services causes.

- 20% spontaneous giving: This part of your plan is designed for needs that arise after you’ve made your plan. Say your church decides to plan a mission trip six months into the year and asks for your support. Also, consider this a reserve fund for needs that will come up over the course of the year, like natural disaster relief, for example.

Here’s how Jake and Kate approached it:

- 50% passion giving: Jake and Kate share a heart for helping the homeless, so they allocated their passion funds accordingly. They divided their $50,000 in this way . . .

- $20,000 to an organization addressing the symptom of the problem (an overnight emergency shelter for families)

- $15,000 to an organization addressing the systemic root cause of the problem (in this case, a mental health organization working with individuals at risk of becoming homeless)

- $10,000 to mercy projects associated with the problem (Jake and Kate chose a ministry that shares the Gospel with the homeless, a job training nonprofit that equips the homeless for employment)

- $5,000 to a younger organization on the cutting edge, trying a new approach to tackle the problem (in this instance, a faith-based transitional housing program that helps moms learn the life skills they need to find and keep a home)

- 30% community giving: Jake and Kate have a number of local organizations close to their hearts. They divided their $30,000 like this . . .

- $15,000 to their church

- $10,000 to the private school where Kate serves on board

- $3,500 to the alumni organization of their alma mater for a building project

- $1,500 as $500 for each of their three children to give away between Thanksgiving and Christmas

- 20% spontaneous giving: Kate and Jake reserved this $20,000 for needs that arose throughout the year. Here’s how they split it up . . .

- $10,000 to friends’ favorite charities when invited to banquets and fundraisers

- $7,500 in response to specific charity appeals, mostly nonprofits they have supported in the past (mostly $500 increments)

- $2,500 given anonymously to a struggling family at their church who had an unexpected and urgent need

3. How will you know if your giving is effective?

Regular giving reviews ensure intentionality throughout the year. These conversations are a chance to check in on your strategy and confirm that you are giving generously and according to plan. Get them on the calendar now, before life gets busy. You might ask your financial advisor to hold you accountable for keeping your reviews a priority.

Reviews should certainly include both you and your spouse, but prayerfully consider who else should be invited. Older children can learn a lot from these conversations, both about the value of money and the importance of being generous with what we have. Grandparents, consider inviting your children and grandchildren to establish a family tradition of generosity.

At each meeting, look at past giving, as well as what future giving you want to do. Here’s a review checklist to get you started:

For past gifts:

- Anything to report to each other? This might include kids telling parents or grandparents how allocated funds were used.

- What was the impact of your gifts? Follow up with organizations if you need more information on how projects came to fruition.

- What went well last quarter? What did not go well? Anything to do differently now?

To plan future giving:

- Check in with your giving plan progress. How much have you already given, and what is allocated for the next quarter?

- Where do you feel called to contribute in the future? Any charities to research more?

- What asks have you fielded recently? Any donation requests you want to respond to?

- Evaluate what has happened personally and professionally. Based on your budget, do you need to adjust your giving plan?

So, back to Jake and Kate. In January, they scheduled giving reviews for the next March, June, September and December. Even when their calendars felt full, they honored the commitment and met with their children for these reviews. Kate’s parents were even able to join them for the June giving review. In September, they reminded their kids about the $500 they each could donate during the holiday season. By Christmas, each child had chosen a charity they loved.

Jake and Kate’s alma mater had broken ground on the new building, thanks in part to their gift. By December, nearly 50 single parents had received job training because of Jake and Kate’s donation. The family from church was back on their feet. Most importantly, the whole family could see how being generous had made an impact.

Ready to move towards giving strategically? Your giving pie may be sliced differently based on the amount you have to give, but asking these questions will help you become more intentional in the way that you do your giving.

We at Sound Stewardship are here to come alongside you and your spouse to build a plan for your generosity. Contact us to get started.

< Back to Updates