Financial advice that changed my life

Right after we got married, my wife and I attended a seminar on basic financial literacy. Although the class wasn’t designed specifically for young couples, the timing was just right to help us start our new household on solid financial footing.

This was before most people had heard of Dave Ramsey and before today’s overwhelming variety of online financial tools and philosophies.

I had grown up in a modest, financially responsible family, but—like most families—we did not often discuss money. Any financial lessons in school centered around writing checks and balancing a checkbook. This lack of financial training is typical, as I’ve discovered after a decade of helping others with their money.

A wealth of common sense

I’ve never forgotten the advice that the facilitator, a financial advisor from our church, shared with us that day. The advice that changed my life wasn’t complicated , and it didn’t include any mathematical formulas. In fact, it profoundly changed the way we used our money precisely because it was so simple and straightforward.

What I’m about to share may be considered common sense. However, I can tell you, having helped hundreds of people with their finances now, living this way is not common.

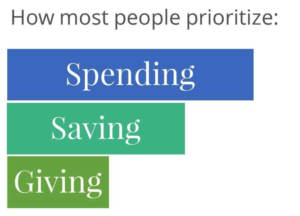

The majority of people manage their money like this:

First, they spend it on their current lifestyle “needs,” such as mortgages, groceries, or football tickets. Then, they save for items down the road, such as a couch next month, an unforeseen emergency next year, or retirement next decade. Finally, if there is anything left over, they give to others or charities.

Dysfunctional thinking: Saving and giving come from what’s left after lifestyle spending.

The reframe that changed our finances

That’s how most people live: spend, save, give. But to make long-term progress with your money, you have to flip the script. Re-prioritize your cash flow like this:

-

- First give the amount you believe you should.

-

- Then save according to your goals.

- Finally, spend on your lifestyle with what’s left.

This reversal has big implications. If you give and save first, your decisions about housing, transportation and travel are limited to a smaller budget than what’s technically possible. It’s an automated way of living within your means. Flipping the common financial script protects against the kind of lifestyle creep that keeps spend-first people playing catch up or getting to the end of well-compensated careers without enough savings.

Life-changing reframe: Progress comes from spending after prioritizing giving and saving.

Setting your own priorities

Of course, I’m working under the assumption that saving and giving are already important priorities to you. If they’re not, we’ve written elsewhere on the importance of saving and how generosity is the secret to true wealth. I don’t have time to convince you here. My point now is that whatever your priorities, they won’t happen without intentionality. It’s the financial application of Stephen Covey’s “big rocks” principle—putting the most important things in your life first.

If you need help reordering your personal spending plan, you don’t have to do it alone. The outside perspective of a professional financial planner can be exactly what’s needed to bring clarity to your process. Ready to re-prioritize? Contact us.

< Back to Updates