Is a downturn inevitable?

This headline from CNN caught my attention: “Forecast says double-dip recession is imminent.” The article quotes a leading forecaster from the Economic Cycle Research Institute:

“It’s either just begun, or it’s right in front of us. But at this point that’s a detail. The critical news is there’s no turning back. We are going to have a new recession.”

A similar story from Fortune Magazine cites a prominent economist who is “…ninety-nine percent sure we will have another recession by the end of next year.”

The flaw in these forecasts is obvious once you have a little context: These predictions are from the year 2011.

The decline these prognosticators were sure about did not materialize. In fact, through April 2019, the United States economy grew an average of more than two percent per year since 2011.* An investment in an S&P 500 index fund would have more than doubled since then.** Unfortunately, some heeded these premature alarms and sold their investments. They missed out on growth because of an “expert” opinion.

Déjà vu all over again?

We find ourselves again in an environment where more voices are suggesting a recession is on its way. Few expect it to hit in 2019, but pessimism is the general consensus. Volatility has increased in the stock market. Headlines seem to be sounding warning alarms daily. Everyone is looking for the stat that will foretell the end of the party.

Is this a false alarm again? Or are the confident pundits reading better tea leaves this time? Our clients, understandably, are concerned. The scars from the Great Recession aren’t quite gone. The attendant market crash hasn’t been forgotten. No one wants to be the last one standing when the music stops this time.

Market cycles as a fact of life?

It seems to be a law of basic human nature that we as large groups (markets) whipsaw between trends of super-optimism and ultra-pessimism. Financial cycles come about when the optimism causes us (or our companies) to overextend ourselves, taking on too much debt and depending on income that may not materialize. Downturns become steep when reality sets in. Pessimism causes us to overreact, making deep spending cuts. This further reduces the income available to others from our purchases.

These cycles are so common that it would seem foolish to not expect them. Just scroll through this list of recessions in the U.S. since its founding. It seems inevitable that a downturn is coming at some time or another.

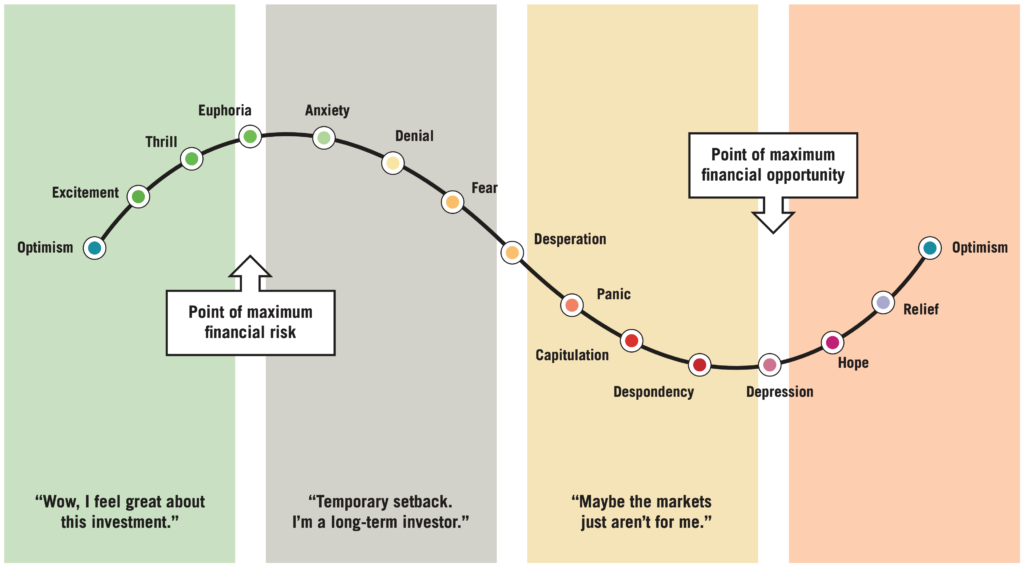

Roller coaster ride of typical emotional investor

There is no crystal ball.

Saying that a downturn is coming is not that same as saying one is coming soon. We refuse to predict the future at Sound Stewardship, and we are decidedly neutral in outlook. It is very possible that trade wars, geopolitical conflict, political uncertainty, etc., could contribute to an atmosphere of fear and unease. Any number of things could tip us toward the wrong direction.

However, investor worries about a slowdown have also kept markets from the unreasonable euphoria that often contributes to crashes. All of the anxiety could actually contribute to conservative decision-making and continued strong economic fundamentals. Although economies are cyclical, they do not have a fixed lifespan after which they must turn around. For instance, Australia hasn’t experienced a recession in almost 30 years. As one portfolio manager has put it, “Bull markets don’t die of old age.”

If we were to bet on anything, we would bet that there is a high likelihood of a recession or dramatic market drop…sometime in your lifetime. It will probably happen a number of times. Whether big or small, we have helped clients carefully navigate downturns in the past, and we know we will be there to help for the next one.

What to do next?

What does all this mean for your decisions today? Prudence is an important part of any financial plan. But at the end of the day, you should focus most on what you can control. Neither you nor I can choose whether a recession happens soon.

So in light of current events, what measured steps should you take with your finances? These three recommendations will prepare you whether there’s a downturn or boom around the corner. That’s the advantage to living according to principles: They work in any economic situation.

Here are three things you can do if you are worried about a downturn:

- Maintain healthy cash reserves. Whether you are working and worried about potential layoffs or retired and worried about a downturn in your portfolio, having cash savings will help you through significant financial fluctuations.

- Minimize unnecessary debt. Debt creates an added burden in the midst of a money crunch because these payments are usually fixed. Reduce debt to create maximum flexibility in your budget if needed.

- Manage investments for the long-term. Investing is by definition a long-term endeavor, and investors inevitably choose poorly when making emotion-based, short-term decisions. Sound Stewardship clients, on the other hand, work with their Wealth Advisors to determine their investing time horizon and create an allocation accordingly. Their diversified portfolios are built to weather economic storms, not avoid them. (Market timing does not consistently work!) Techniques like strategic rebalancing, tax-loss harvesting, and dollar-cost averaging can create opportunities within downturns.

If you have already done all of these things, what are you worried about? Whether or not a financial recession or market downturn happens soon is completely outside your control or mine. As it’s been said, “Which of you by worrying can add one cubit to his stature?” Rather than focusing on what we can’t control, turn off the news and instead concentrate on the things we can.

If you would like to talk with a Wealth Advisor about creating your own recession-proof plan, contact us today to get started.

* As measured by Gross Domestic Product. Source: US Bureau of Economic Analysis.

** Source: Morningstar, using iShares Core S&P 500 ETF (IVV) from 1/3/2012 – 7/1/2019.