The Biggest Gift of the New Tax Law

A few months after the passage of the Tax Cuts and Jobs Act of 2017, many of us are considering its practical impact. One particularly thought-provoking aspect of the act is the change in deduction thresholds, with a higher bar to clear for itemizing. It’s tempting to use the new legislation as an excuse to curtail your generosity. Without the tax deduction, then what’s the point of giving?

But if that is your line of reasoning, then you have missed the real reason for generosity. Giving was never about the deduction in the first place. We give generously because we are called to help others.

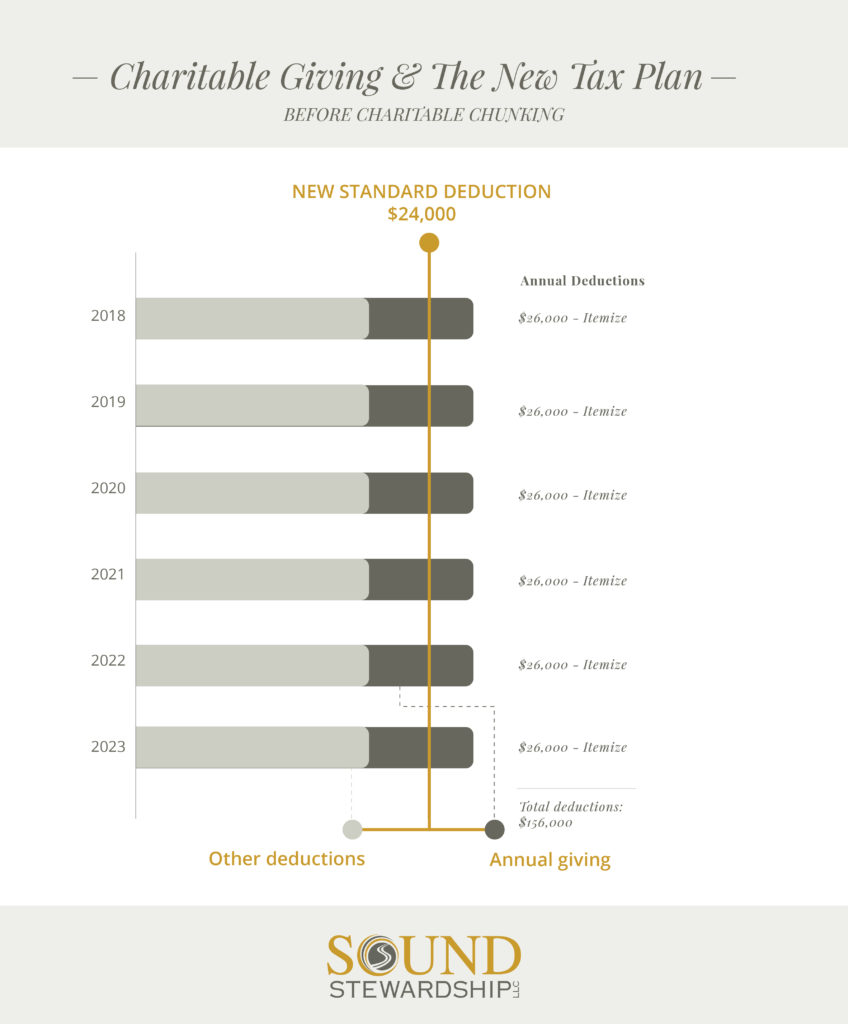

To recap, the Tax Cuts and Jobs Act of 2017 is a bit of a mixed bag from a charitable giving perspective. On the plus side, a donor’s ability to deduct charitable donations actually increased. Before, donors were able to deduct up to 50% of their income from cash donations; under the new legislation, that expanded to 60%. However, rules surrounding itemizing have also changed. The legislation roughly doubles the standard deduction, to $12,000 for individuals and $24,000 for couples. Donors who have itemized in the past now have a higher bar to clear.

The higher deduction threshold has some donors reconsidering giving. Without “getting credit” for the donation, what’s the point? While the circumstances may have changed, our calling remains steadfast. We give generously in response to this calling, regardless of tax perks.

Generosity has numerous benefits — and regular, intentional giving can lead to a life of joy and abundance. From a Christian perspective, we look to verses like 1 Timothy 6:18 and Romans 12:13, verses that tell us to put our hope in God, not our earthly possessions, and to give to others as a result. We’ve been called to give for centuries, long before IRS tax codes were established and tax incentives were designed.

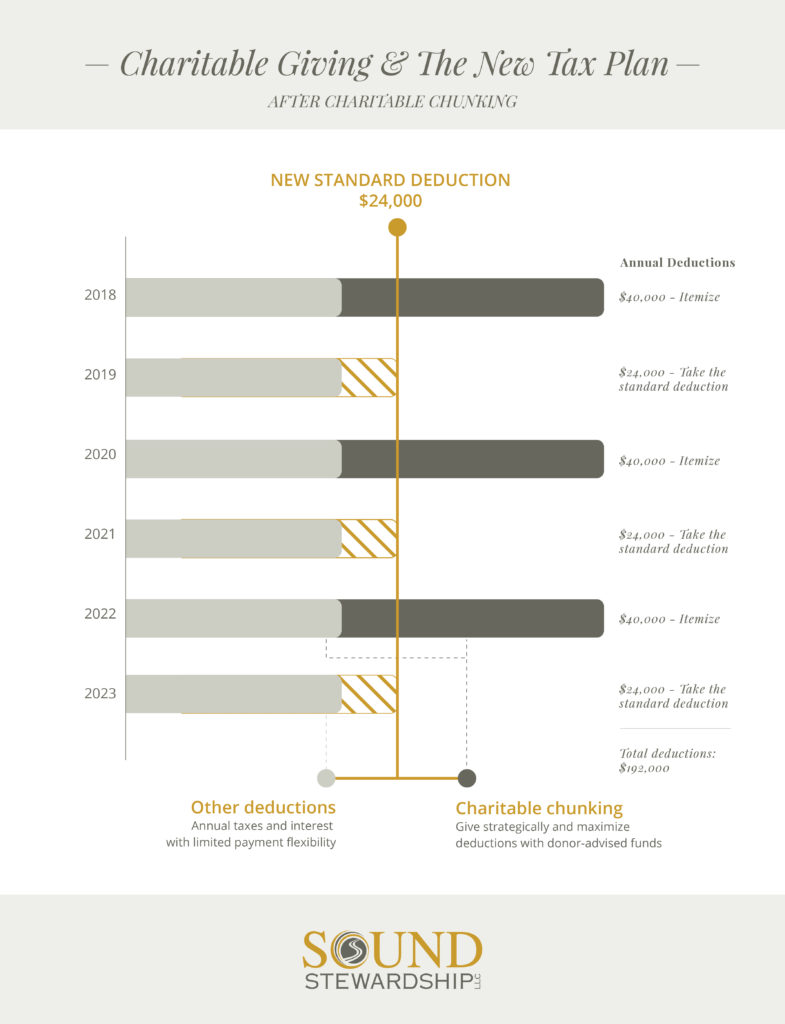

Part of being a good steward of our wealth is taking an intentional approach. As you affirm your commitment to generosity, you can also consider opportunities to optimize your charitable giving. These strategies have unique implications depending on your unique situation, so discuss them with your Wealth Advisor to see if they could be right for you. One approach we are sharing with clients is “charitable chunking” with a Donor Advised Fund.

Here’s how “charitable chunking” works: bundle a few years worth of giving, and then donate all at once for a larger gift that does qualify for the deduction. For example, if you typically give $20,000 each year, combine next year’s $20,000 with this year’s $20,000 to make a $40,000 gift (qualifying you for the itemized deduction). I realize it takes having enough assets saved to be able to “double up” on your deductions. And, donors may also be concerned that bunching all their giving into one year creates discomfort for the nonprofit.

This is where, for those with available resources, a Donor Advised Fund (DAF) is a powerful tool to maximize your charitable giving in response to the new tax law. You receive the deduction when you contribute to your fund, then give to the nonprofits at the timing of your choice. So, in conjunction with the “charitable chunking” method, you can make larger gifts to the DAF and claim the deduction, then transfer desired amounts from the DAF to the nonprofits at regular intervals. You could even set up automatic monthly gifts to organizations you give to regularly. At the end of the day, you could maintain a steady flow of donations to your charity, while also increasing your deductions over time.

There will always be people in need, causes to support, initiatives to champion. So in light of this new legislation, consider how you can be a strategic and intentional donor — but don’t stop giving. Tax deductions are a byproduct of living in the United States, and while they may be nice perks, they should never be our motivation for donating.

At Sound Stewardship, we will continue encouraging people to give generously throughout their lifetimes. Reach out to us at 913-317-6000 to learn more about this unique approach and how it might fit your giving strategy.

For more resources on wise charitable giving, explore these additional posts:

- Learn how to become more strategic with donations

- Make a major gift to a nonprofit in a way that’s smart

- Determine whether or not you should give to overhead

< Back to Insights